How to Invest in Gold: A Beginner's Guide

Gold is one of the oldest and most important investment assets in the world. It has retained its value over centuries and played a significant role in hedging wealth against inflation and economic crises.

Therefore, many investors, especially beginners, turn to gold investment to diversify their portfolios and reduce risk.

In this article, we will provide you with a comprehensive guide on how to invest in gold, along with valuable tips for beginners:

1. Understand the types of gold investments:

- Physical gold purchase: This includes buying gold bars (such as bars, plates, and coins) or gold jewelry. This option is traditional and provides tangible ownership of gold.

- Investing in gold-linked financial instruments: These instruments include gold exchange-traded funds (ETFs), gold futures, and stocks in gold mining companies. These instruments offer ease of trading and greater investment diversification.

2. Define your investment goals:

- Are you aiming to invest in the short term (trading) or long term (holding)?

- What is your risk tolerance?

- How much money can you invest?

3. Choose the most appropriate investment method:

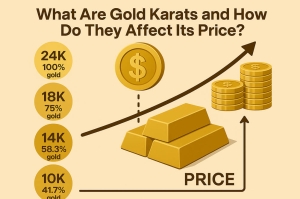

- For beginners, it is recommended to start by buying gold bars or gold jewelry. You can buy them from reputable jewelry stores or banks. Make sure to get a certificate that proves the purity of the gold.

- For more experienced investors, you can invest in gold ETFs or gold futures. These instruments require more knowledge and experience in the financial markets.

4. Diversify your investments:

- Don't put all your money into one investment, even if it's gold. Allocate your investments across different assets, such as stocks, bonds, and real estate. This helps reduce risk and achieve better returns in the long run.

5. Follow an investment strategy:

- Develop a clear plan for investing in gold.

- Assess the potential risks and rewards of each investment.

- Monitor gold prices regularly and make buying and selling decisions based on your analysis.

6. Important tips for beginners:

- Start with small amounts and gain experience gradually.

- Don't invest money you can't afford to lose.

- Research thoroughly before making any investment decision.

- Consult a financial advisor if you need assistance.

- Remember that investing in gold involves risks, but it can also provide rewarding returns in the long run.

In conclusion, investing in gold is a good option to diversify investment portfolios and hedge wealth. By following a smart investment strategy and making informed decisions, you can benefit from the advantages of gold and achieve rewarding returns in the long run.