Experts Comment on Gold’s Sharpest Fall in Five Years

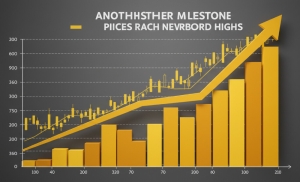

After marking the strongest annual performance in 45 years, gold prices faced their steepest one-day decline since 2020 as of Tuesday’s close. Analysts shared their views on the sudden correction.

Starting the year at $2,623 per ounce, gold gained over 60% amid economic uncertainty, geopolitical tensions, interest rate cut expectations, central bank purchases, and strong ETF inflows. Yet, after months of rallying, the metal lost 5.28% to $4,125 per ounce, while gram gold fell 5.26% to ₺5,567.

“A Needed Technical Correction”

Matt Simpson, senior analyst at StoneX, said the decline came as U.S.–China trade tensions eased: “Reduced friction reversed gold’s upward momentum. After such a long rally above $4,000, this was a necessary technical correction.”

“Below $4,000 Could Trigger a Bigger Sell-Off”

Nicholas Frappell of ABC Refinery commented that investors might have chosen to realize profits: “If prices drop clearly below $4,000, we could see a larger wave of selling,” he warned.